Unveiling the World of Microcaptives: A Closer Look

Microcaptives, a unique form of captive insurance companies, have been gaining significant attention in the business world. With the introduction of the IRS 831(b) tax code, these microcaptives have emerged as a viable alternative for small to mid-sized businesses seeking to manage their risks in a more efficient and cost-effective manner. But what exactly is a microcaptive, and how does it differ from traditional captive insurance? Let’s delve into this fascinating realm and unveil the world of microcaptives.

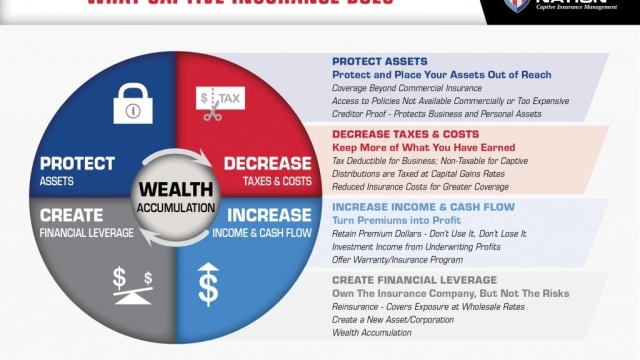

At its core, a microcaptive is a closely-held insurance company that provides coverage predominantly to its owners and affiliated entities. These captives operate under the guidance of the IRS 831(b) tax code, which offers a favorable tax treatment for companies meeting specific criteria. Unlike traditional captives, microcaptives are structured to cater to the needs of smaller businesses, allowing them to enjoy the benefits of captive insurance without the burdensome capital requirements. By leveraging the tax advantages provided by the IRS 831(b) tax code, these microcaptives enable businesses to retain more control over their risks, potentially reducing their overall insurance costs.

Understanding Microcaptives

A microcaptive refers to a small captive insurance company that is formed by a business entity or a group of related entities to self-insure their risks. This alternative risk management strategy has gained popularity particularly among small and mid-sized businesses in recent years. The concept of microcaptives revolves around the idea of creating a separate legal entity that provides insurance coverage exclusively to its owners or affiliated companies.

One notable aspect of microcaptives is their utilization of the IRS 831(b) tax code. This provision allows qualifying small insurance companies, such as microcaptives, to receive certain tax benefits. In particular, under this tax code, microcaptives can elect to be taxed only on their investment income, while the premium income they earn is tax-exempt. This has led to increased interest in microcaptives as a financially favorable risk management tool.

Captive insurance in itself refers to an arrangement where a company forms its own insurance subsidiary to provide coverage for the risks it faces. With microcaptives, the focus is on smaller-scale operations that cater to specific businesses or groups of entities. These microcaptives can offer coverage for a wide range of risks that may not be readily available or cost-effective through traditional insurance markets. By forming their own captive insurance company, businesses aim to gain more control over their risk management strategies and potentially reduce their overall insurance costs.

The Benefits of the 831(b) Tax Code

Microcaptives, also known as 831(b) captives, have gained significant attention due to the benefits provided by the 831(b) tax code. This tax provision allows small captive insurance companies to receive certain tax advantages, making it an attractive option for many businesses.

One of the main benefits of the 831(b) tax code is the potential for tax savings. Under this provision, microcaptives can receive up to $2.3 million in annual premiums without being subject to federal income tax on those premiums. This tax exemption can result in significant savings for businesses, allowing them to retain more of their profits.

In addition to tax savings, the 831(b) tax code also offers businesses the opportunity to control their own insurance risks. By setting up a microcaptive, companies can customize their insurance coverage to suit their specific needs, rather than relying on traditional insurance policies. This level of control can provide businesses with more tailored coverage and potentially reduce their overall insurance costs.

831b

Furthermore, microcaptives created under the 831(b) tax code have the potential to accumulate funds tax-free. Any underwriting profits or investment income generated by the microcaptive can be retained within the company without immediate tax consequences. This allows the captive to build reserves and strengthen its financial position over time.

In conclusion, the 831(b) tax code offers several enticing benefits for businesses considering the microcaptive route. From potential tax savings to increased control over insurance risks and the ability to accumulate funds tax-free, this tax provision can be a valuable tool for businesses looking to optimize their insurance strategies.

Potential Risks and Controversies

Microcaptives, also known as 831(b) captives, have gained popularity in recent years due to their potential benefits for small businesses. However, there are certain risks and controversies associated with these arrangements that should be carefully considered.

Firstly, there is a level of regulatory scrutiny surrounding microcaptives. The IRS has been actively monitoring these entities to ensure compliance with the 831(b) tax code. This heightened attention has led to increased audits and examinations, which can be time-consuming and costly for the businesses involved. It is essential for microcaptive owners to maintain proper documentation and adhere to the guidelines set forth by the IRS to avoid potential penalties and legal complications.

Secondly, there is a risk of abuse and misuse of microcaptives for tax evasion purposes. Some businesses may be tempted to form microcaptives primarily to take advantage of the favorable tax benefits, rather than for legitimate risk management purposes. This has raised concerns among regulators and policymakers, leading to calls for stricter regulations and potentially limiting the availability of these tax advantages in the future.

Lastly, the success of a microcaptive largely depends on effective risk management. Inadequate assessment and management of risks can leave businesses financially vulnerable. If the microcaptive fails to adequately cover the insured risks, or if excessive claims are made, it could deplete the reserves and jeopardize the company’s financial stability.

In conclusion, while microcaptives present opportunities for small businesses, it is crucial to be aware of the potential risks and controversies surrounding these arrangements. Careful compliance with regulatory requirements and responsible risk management practices are essential to ensure the long-term viability and success of microcaptive insurance programs.