Protecting Your Haven: Unveiling the Power of Home Insurance

Your home is more than just a physical structure; it’s a sanctuary where memories are made and cherished. However, life is unpredictable, and unforeseen circumstances can pose a threat to the haven you’ve created. That’s where home insurance steps in, offering you a shield to protect your most valuable asset. Whether it’s the ravages of nature, accidents, or theft, home insurance provides the peace of mind you need to truly enjoy and safeguard your haven.

When it comes to insurance, there are various types to consider, such as commercial auto insurance and life insurance. However, home insurance stands out as a crucial aspect of comprehensive coverage, ensuring that your personal dwelling and its contents remain protected against a multitude of risks. From fire and windstorm damage to burglaries and liability claims, home insurance acts as a financial safety net that shields you from the potential financial burden that these unfortunate events can bring. It’s a reliable companion that understands the value of your hard-earned investment and aims to preserve the comfort and security of your haven.

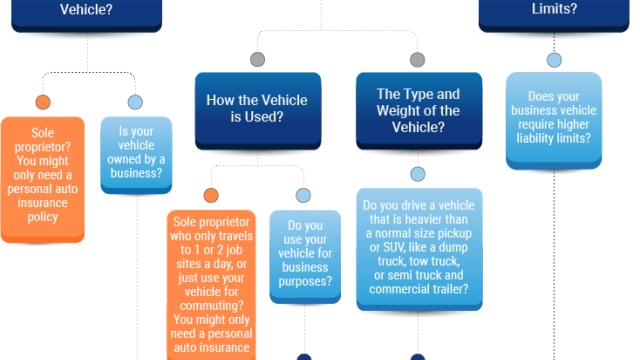

Understanding Commercial Auto Insurance

When it comes to protecting your business assets, commercial auto insurance plays a crucial role. This type of insurance is specifically designed to provide coverage for vehicles used in your business operations. Whether you have company cars, delivery trucks, or service vehicles, commercial auto insurance ensures that you are protected in the event of any accidents, damages, or liabilities.

Connecticut ATV Insurance

Having commercial auto insurance gives you peace of mind knowing that your business vehicles are financially protected. In case of an accident, this insurance coverage will help cover the cost of repairs or replacements for the vehicles involved. Additionally, it can also provide coverage for any third-party property damage or bodily injury claims that may arise from the accident.

Moreover, commercial auto insurance also offers protection against theft, vandalism, and other unexpected incidents that may affect your business vehicles. It is essential to understand the coverage limits and options available to ensure that you have the right level of protection for your specific business needs.

By securing commercial auto insurance, you are safeguarding your business from potential financial loss due to accidents or unforeseen events. It is recommended to consult with an insurance professional who can help you choose the appropriate coverage that aligns with your business requirements and budget.

Remember, investing in commercial auto insurance is not only a wise financial decision but also a responsible step in protecting your business assets and ensuring the smooth operations of your enterprise.

The Importance of Home Insurance

Home insurance is an essential safeguard for homeowners, providing valuable protection and peace of mind against unforeseen events. From natural disasters to theft or accidents, having the right home insurance coverage ensures that your haven remains secure in even the most unexpected circumstances.

A crucial aspect of home insurance is its ability to mitigate the financial burden of rebuilding or repairing your home due to damage caused by incidents like fires, storms, or vandalism. Without insurance, the expenses associated with such unfortunate events can be overwhelming and often leave homeowners in a state of financial distress.

Moreover, home insurance not only protects the physical structure of your home but also covers your personal belongings. In the event of a burglary or damage caused by accidents like leaks or electrical issues, your insurance policy can provide the necessary funds to replace or repair the affected items.

Additionally, home insurance safeguards you against liability claims that may arise from accidents that occur on your property. If someone were to injure themselves while visiting your home, the liability coverage in your insurance policy helps cover legal expenses and medical bills, preventing you from incurring substantial financial liabilities.

In conclusion, home insurance provides an essential safety net, ensuring that you are financially protected in the face of unforeseen events or accidents. By securing the right home insurance coverage, you can rest assured that your haven and everything within it are protected, allowing you to enjoy the comfort and security of your home to the fullest extent.

Securing Your Future with Life Insurance

Having a comprehensive insurance plan that covers all aspects of your life is essential for securing your future and providing financial protection for yourself and your loved ones. While home insurance and commercial auto insurance may safeguard your physical assets, life insurance goes a step further by providing a safety net for your family and loved ones in the event of an unfortunate incident.

Life insurance serves as a financial cushion for your loved ones by providing a lump sum payment or regular income replacement in the event of your untimely passing. This ensures that your family can maintain their current lifestyle, meet basic needs, and even plan for the future, even if you’re no longer there to provide for them.

One of the key benefits of life insurance is that it helps alleviate financial burdens, such as outstanding debts, mortgage payments, and educational expenses. By having a life insurance policy in place, you can rest assured that your loved ones won’t be burdened with these financial obligations, allowing them to focus on healing and moving forward during a difficult time.

Life insurance also provides an opportunity for you to leave a legacy and support causes close to your heart. By designating beneficiaries or charitable organizations in your life insurance policy, you can contribute to their financial stability or make a positive impact even after you’re gone.

In conclusion, while commercial auto insurance and home insurance offer protection for your physical assets, life insurance secures your family’s future and provides them with the means to navigate through challenging times. By including life insurance in your overall insurance plan, you can ensure peace of mind and guarantee financial security for your loved ones, even in your absence.